Loan Service Solutions: Your Path to Financial Flexibility

Wiki Article

Accessibility Versatile Car Loan Solutions Designed to Fit Your Distinct Circumstance

In today's vibrant monetary landscape, the value of accessing flexible loan services customized to specific circumstances can not be overemphasized. As individuals navigate through life's numerous turning points and unforeseen obstacles, having the ideal monetary support can make all the difference. Imagine having a lending service that adapts to your distinct demands, supplying a variety of alternatives that line up with your certain scenario. This degree of modification can provide a feeling of safety and security and empowerment, enabling you to navigate financial decisions with confidence. Yet exactly what makes these adaptable finance services stick out, and how can they absolutely deal with your ever-evolving economic demands?Benefits of Flexible Car Loan Services

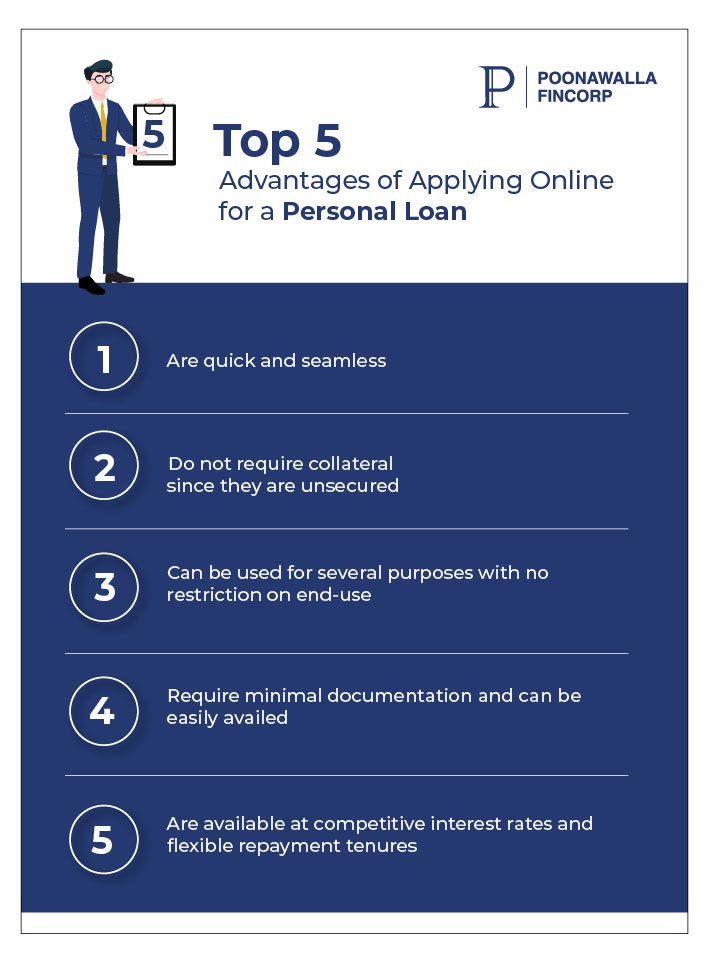

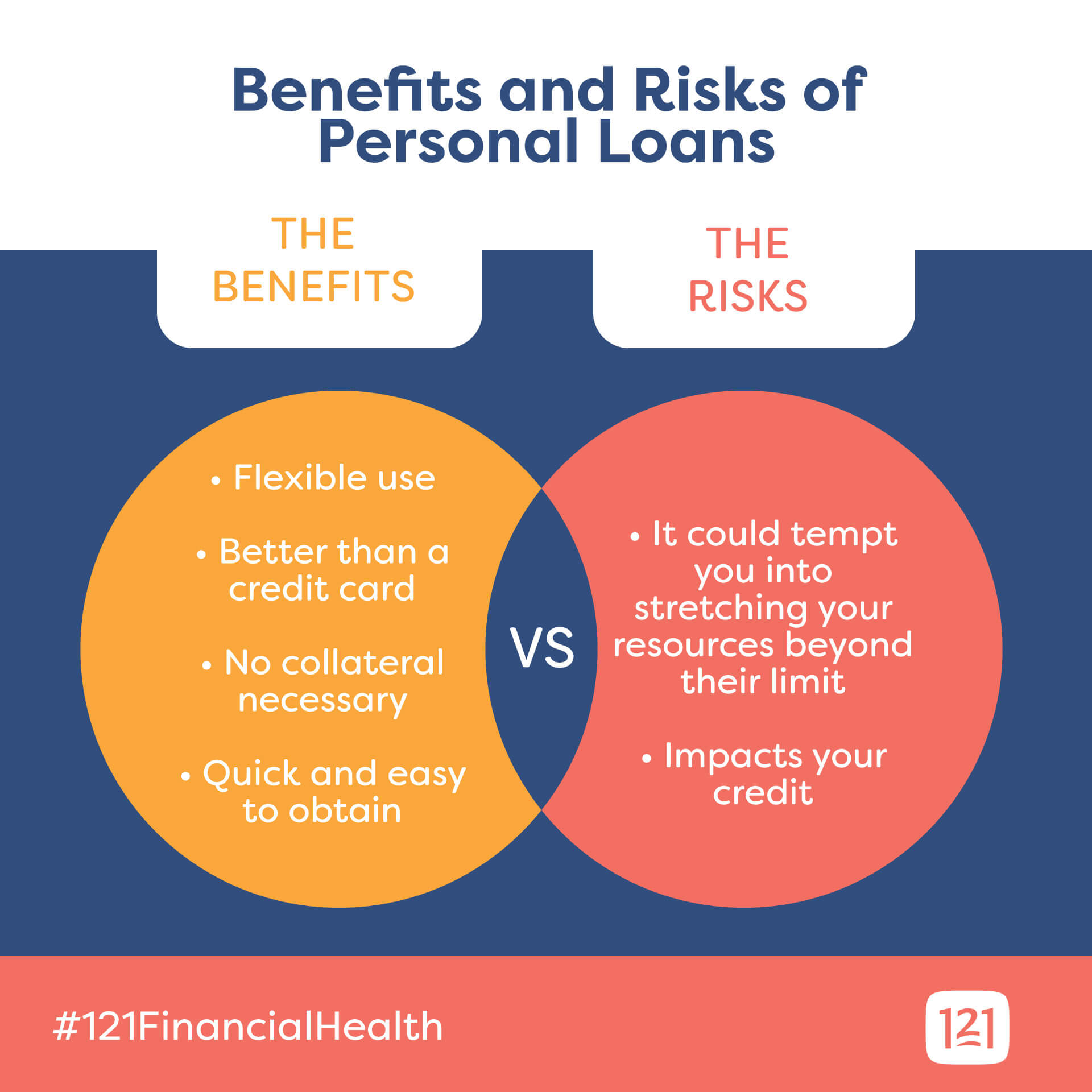

Versatile financing services provide borrowers the benefit of customizing repayment terms to fit their financial scenarios and objectives. Additionally, flexible funding services commonly use the ability to make extra repayments or pay off the loan early without incurring penalties. On the whole, the benefits of flexible lending solutions give customers with the tools they require to properly manage their funds and accomplish their long-term economic objectives.Understanding Your Borrowing Options

For individuals looking to fund higher education, trainee fundings present a feasible option with versatile settlement strategies. Additionally, individuals with existing homeownership can leverage home equity loans or lines of credit scores to access funds based on the equity in their homes. Understanding these borrowing options enables individuals to make enlightened decisions based on their monetary goals and conditions, ensuring that they select the most suitable finance item to fulfill their demands.Tailoring Finance Terms to Your Requirements

When borrowers assess their economic needs abreast with various car loan alternatives, they can tactically tailor lending terms to match their details requirements. Tailoring lending terms involves a thorough analysis of variables such as the wanted loan quantity, settlement duration, rates of interest, and any added charges. By recognizing these aspects, customers can negotiate with lending institutions to develop a car loan contract that aligns with their monetary goals.

Additionally, debtors can discuss for flexible terms that enable modifications in situation of unanticipated financial obstacles. This can consist of choices for settlement deferrals, loan extensions, or alterations to the settlement routine. Ultimately, customizing car loan terms to individual needs can lead to a more workable and customized borrowing experience.

Handling Settlement With Ease

To ensure a smooth and reliable settlement procedure, customers must proactively intend and organize their economic administration methods. Additionally, producing a spending plan that focuses on car loan payments can assist in handling funds effectively.In cases where customers run into economic troubles, it is vital to connect with the loan provider without delay. Numerous lending institutions provide alternatives such as loan restructuring or temporary settlement deferrals to assist people facing challenges. merchant cash advance same day funding. Financial Assistant. By being transparent concerning financial conditions, consumers can function in the direction of mutually useful solutions with the loan provider

Furthermore, it is useful to explore chances for very early settlement if feasible. Repaying the funding in advance of schedule can minimize total passion expenses and offer financial relief over time. By staying proactive, communicating honestly, and discovering repayment approaches, consumers can successfully manage their loan commitments and accomplish monetary stability.

Securing Your Financial Future

Safeguarding your monetary future is a vital element of achieving peace of mind and long-term stability. By creating a detailed financial strategy, individuals can establish clear objectives, establish a budget, save for emergencies, spend intelligently, and shield their assets with insurance coverage.Furthermore, diversifying your financial investments can assist mitigate threats and improve total returns - mca loan companies. By spreading out investments throughout different property courses such as stocks, bonds, and real estate, you can decrease the impact of market fluctuations on your profile. Routinely examining and adjusting your monetary plan as your situations alter is similarly important to remain on track in the direction of your goals

Basically, thorough financial planning is the foundation for a safe and secure economic future. It offers a roadmap for attaining your objectives, you can find out more weathering unforeseen challenges, and eventually appreciating economic stability and satisfaction in the years ahead.

Verdict

To conclude, versatile finance services use an array of advantages for borrowers, giving tailored alternatives to match specific financial scenarios. By understanding borrowing alternatives and tailoring funding terms, individuals can conveniently take care of repayment and protect their financial future. It is necessary to discover these flexible financing services to ensure a positive monetary outcome and accomplish long-lasting economic stability.Report this wiki page